- Link the project/programme/portfolio costs to the organizations cost structure.

- Determine the management processes for the finances.

- Decide which financial indicators you are going to use.

- Develop workable reports.

2 hours CPD

A7.KCI-4 Develop, Establish and Maintain a Financial and Reporting System for the Project

1. Define processes and governance for financial management.

Start by defining processes and roles:

- Payment authorisations (Approval hierarchies)

- Set up approval workflows (e.g., project manager verifies invoices, finance team executes payment).

- Escalation paths & governance:

- Who monitors, who approves, and how exceptions are handled.

Financial reports are the outputs of this system, showing cost vs. progress through indicators such as:

- Cost to Complete

- Earned Value

In many organisations, project financial management must align with existing accounting and controlling systems.

- If standard methods exist, use and adapt them (standard methods) to the project’s needs.

- If not, design and apply a project-specific system.

2. Define financial performance indicators on the project

Establish metrics that link cost and progress, such as:

- Cost Performance Index (CPI): measures cost efficiency.

- Schedule Performance Index (SPI): tracks progress against the baseline.

- Estimate at Completion (EAC): forecasts total project cost.

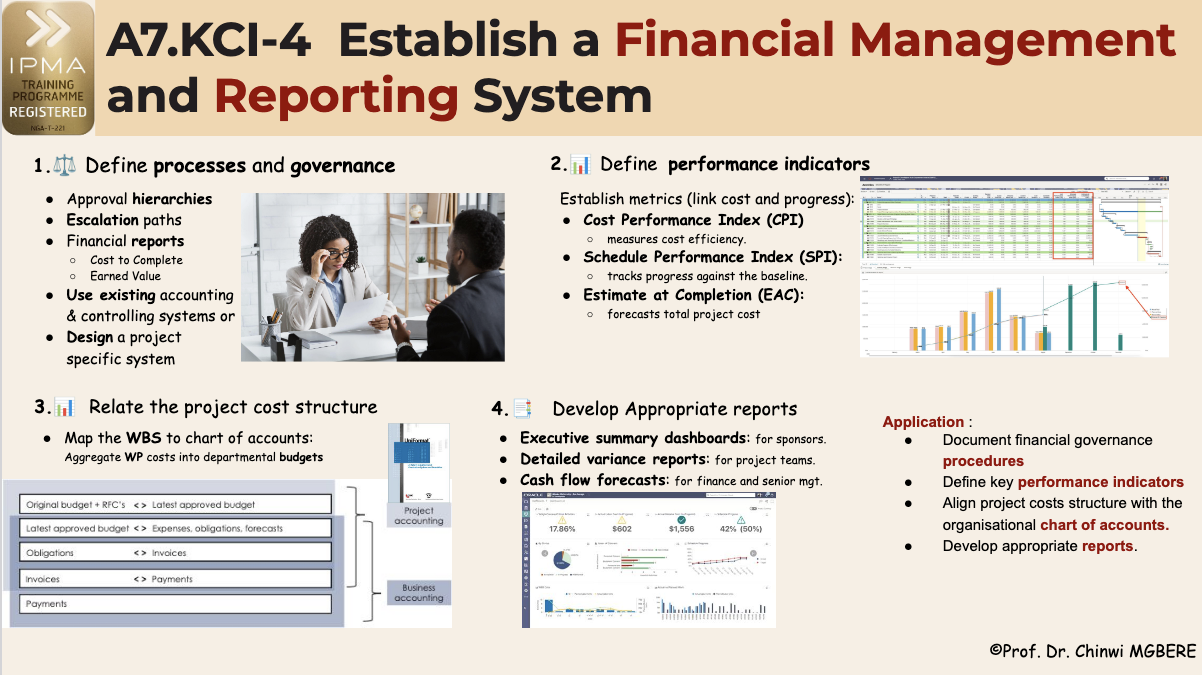

3. Relate the project cost structure to the organisational cost structure

- Map the Work Breakdown Structure (WBS) to the organisation’s chart of accounts.

- Example: Aggregate work package costs into departmental budgets, so both project and finance teams speak the same “language.”

4. Develop appropriate reports in line with project governance

Create reports tailored to the needs of stakeholders:

• Executive summary dashboards for sponsors.

• Detailed variance reports for project teams.

• Cash flow forecasts for finance and senior management.

Use visuals such as charts, earned value curves, and budget vs. actual graphs to make reports easier to interpret.

To apply these actions to your current initiative, follow these steps:

- Document financial governance procedures (e.g., approval hierarchies, escalation paths).

- Select 2–3 key performance indicators (CPI, SPI, EAC) to monitor cost and schedule integration.

- Create a mapping table that aligns WBS elements with the organisational chart of accounts.

- Design report templates (e.g., variance analysis, cash flow tracking) that fit your project’s governance structure.

- This ensures transparency, accountability, and proactive decision-making in project financial management.

Now, Let’s Test Your Knowledge!