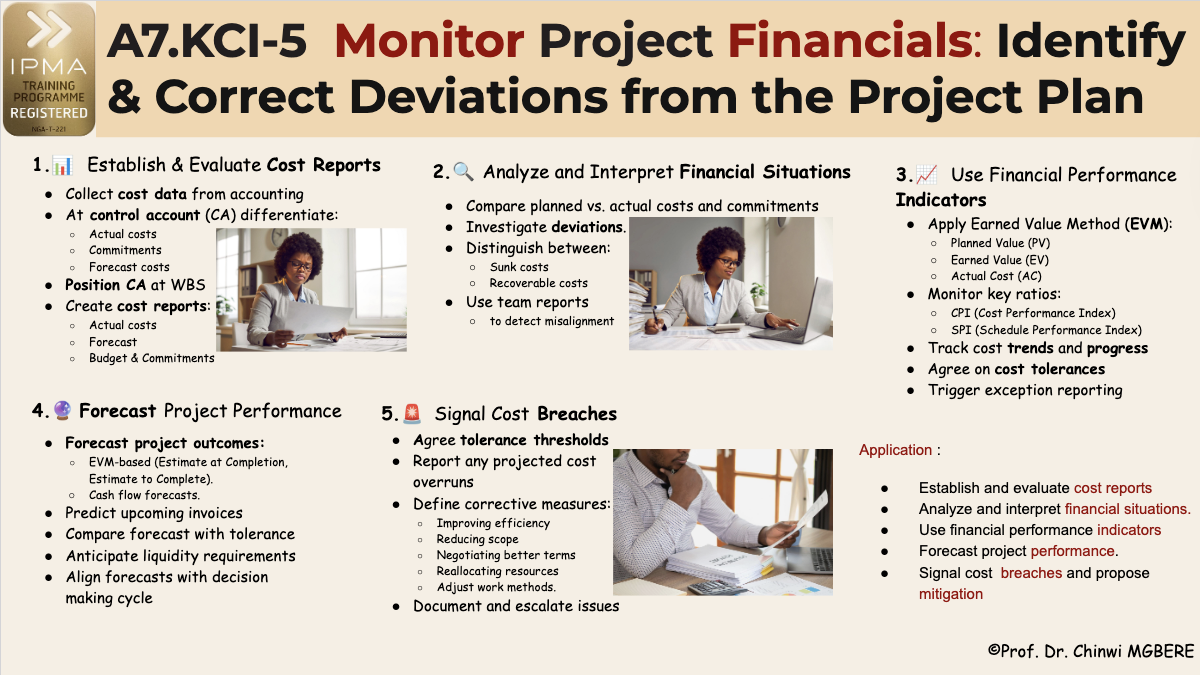

- Produce cost reports.

- Analyze and explain financial situations.

- Make use of performance indicators.

2 hours CPD.

A7.KCI-5, Monitor project financials in order to identify and correct deviations from the project plan

The goal of financial controlling is to spot deviations from the project plan early so that corrective action can be taken.

The project manager monitors:

- Planned vs. actual costs

- Liabilities and commitments (e.g., purchase orders not yet paid)

- Cash flow and forecasts

Planned costs are taken from the latest approved budget. Actual costs come from project team reporting and organizational accounting (labour, travel, materials, consultancies, etc.). Because accounting data often lags, project managers may need their own system for timely tracking.

Using Earned Value Management (EVM) indicators like SPI (Schedule Performance Index) and CPI (Cost Performance Index), managers compare planned cost, actual cost, and actual work progress. This enables proactive decision-making to manage underspending or overspending and to forecast future performance.

If cost overruns are predicted, the manager must report and propose a mitigation plan in line with organizational governance.

1. Establish and Evaluate Cost Reports

- Collect cost data from the organization’s accounting system (invoices, cross-charges, purchase orders) and project team inputs.

- At the control account level, differentiate between:

- Actual costs (invoices/cross-charges received).

- Commitments (purchase orders/contracts placed but not paid).

- Forecast costs (expected future invoices and charges).

- Position control accounts at the right WBS level to align invoices with cost tracking.

- Create structured cost reports showing:

- Actual costs to date

- Forecast for the entire project/programme

- Budget for the next phase/stage/tranche

- Outstanding commitments

2. Analyze and Interpret Financial Situations

- Compare planned vs. actual costs and commitments (at the control account level).

- Investigate deviations and identify their causes.

- Distinguish between:

- Sunk costs (irreversible, not relevant for future decisions).

- Recoverable costs (e.g., supplier errors, warranty claims).

- Use team reports to detect early signals of misalignment.

3. Use Financial Performance Indicators to Monitor and Control the Project

- Apply Earned Value Method (EVM) to link costs with progress:

- Planned Value (PV)

- Earned Value (EV)

- Actual Cost (AC)

- Monitor key ratios:

- CPI (Cost Performance Index): cost efficiency = EV ÷ AC

- SPI (Schedule Performance Index): schedule efficiency = EV ÷ PV

- Track cost trends and progress at both work package and control account levels.

- Agree on cost tolerances with the sponsor (limits within which the project manager can act).

- Trigger exception reporting if forecasts show tolerance breaches.

4. Produce Project Performance Forecasts Based on Financial Indicators

- Forecast future project outcomes using:

- EVM-based projections (Estimate at Completion, Estimate to Complete).

- Cash flow forecasts.

- Predict upcoming invoices and cross-charges based on contracts and progress.

- Compare forecast with tolerance limits agreed with the sponsor.

- Anticipate liquidity requirements (ensuring invoices can be paid on time). Compare expected total costs with available budgets.

- Align forecasts with the sponsor’s decision-making cycle (e.g., before each new phase or tranche).

5. Signal Cost Breaches and Suggest Mitigation Plans

- Establish agreed tolerance thresholds for each phase/tranche.

- Report any projected cost overruns beyond agreed tolerances.

- Collaborate with the sponsor and team to define corrective measures:

- Improving efficiency

- Reducing scope

- Negotiating better procurement terms

- Reallocating resources

- Adjust work methods.

- Document and escalate issues following governance requirements.

To apply these actions to your current initiative:

- Establish and evaluate cost reports regularly by gathering actual, planned, and committed costs.

- Analyze and interpret financial situations, identify deviations and their causes.

- Use financial indicators (SPI, CPI, and other metrics) to track trends.

- Forecast project performance based on financial data.

- Report breaches and propose mitigation when forecasts exceed tolerances.

This proactive approach ensures financial control and supports informed decision-making throughout the project lifecycle.

Now, Let’s Test Your Knowledge!